As five students in a Harvard field class on technology and innovation, we’ve been working with the U.S. Department of Treasury. Based on our research, we’ve built a prototype—Businesses Like Me—a business analytics tool that makes government spending data relevant for small business owners.

Introducing Businesses Like Me

You can check out our open Github repository and try out our tool for yourself! We’d love for you to send any feedback or ideas you have to wlong@college.harvard.edu.

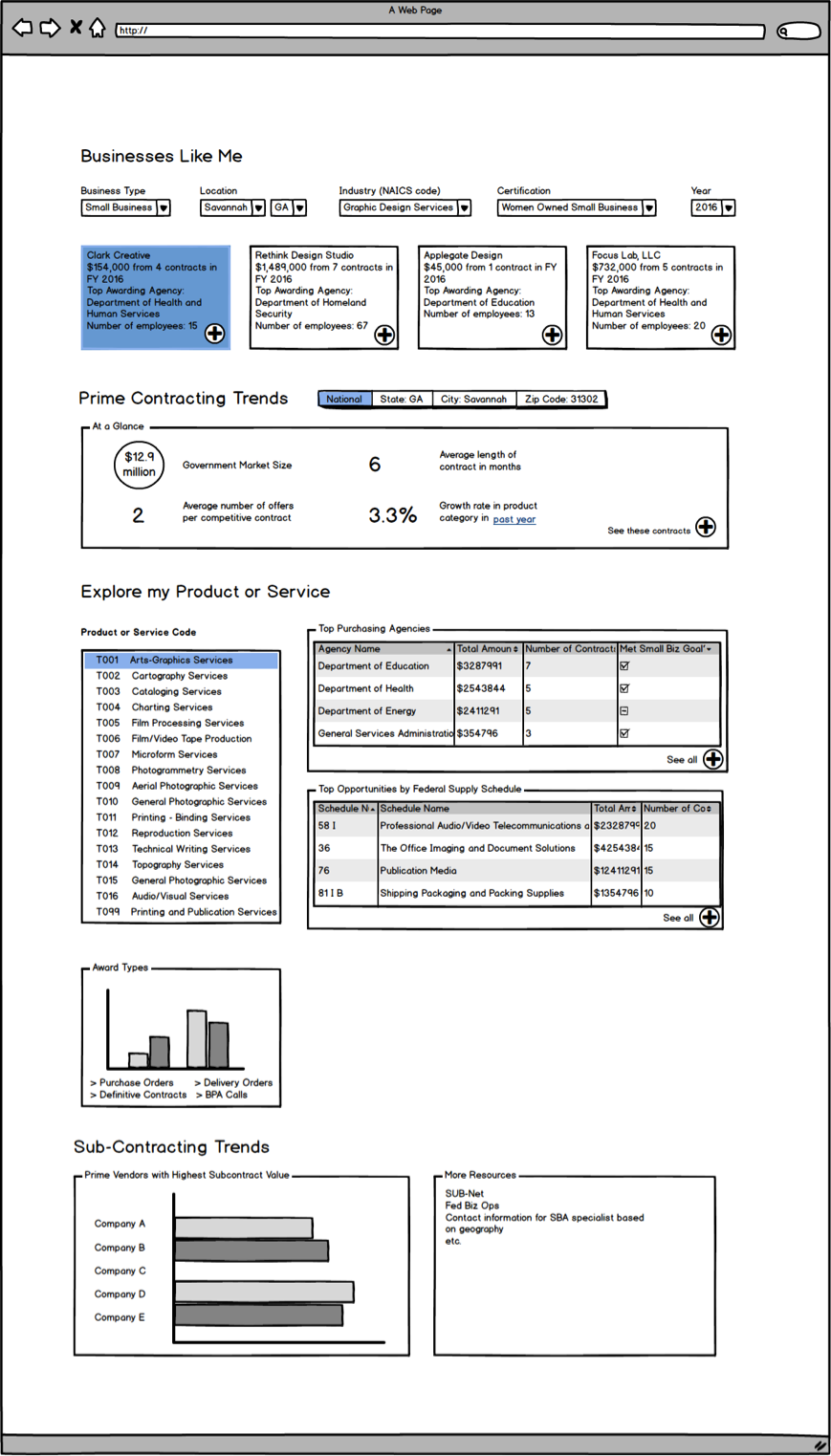

For our prototypical small business owner, imagine Sarah, an owner of a small laundry service based in San Diego. Sarah is always looking for new business opportunities and she’s heard of other laundry services in the area getting contracts from her local military base, but she’s not sure whether it’s worth the time to research the opportunity and pursue contracts. When Sarah arrives on Businesses Like Me, she finds herself here:

The landing page of our prototype asks Sarah three important questions to help her find similar businesses similar with respect to industry, location, and size. This information will help her find all the other laundry services currently in the market for government contracts.

Upon hitting “Search”, Sarah sees a clean and clear dashboard with only information relevant for her. She gets an idea of whether the contract market for laundry services is expanding or contracting, the total size of the market opportunity, and how competitive the market is. Businesses Like Me provides Sarah many other metrics and resources for her to further delve into the data, and contacts if she wants to explore government contracting further.

Other Possible Prototypes

In addition to this actual prototype, we also have three ideas of exciting prototypes for the data and analytics firms we researched. Instead of a finished product, each of these ideas is a way a data-powered company can incorporate government spending data into their existing products.

1. Hacking Congressional Effectiveness with Quorum

Quorum is a legislative and congressional data analytics firm. Combining their representative profiles with spending data in their district would uncover interesting correlations between representatives’ behaviors and changes in government contracts.

2. Mapping Entity Identifiers with Thomson Reuters

Thomson Reuters is a business analytics firm that has developed an open-source universal entity identifier called PermID. Unfortunately, much of government data has used the proprietary DUNS number. Mapping between DUNS and PermID with spending data fields could potentially solve a huge open problem in the data analytics industry.

3. Pricing Mortgages Accurately with Fannie Mae

40% of Fannie Mae’s revenue comes from arbitraging the true value of a set of mortgages and the security price. Using Treasury data to track changes in government spending by industry or location could allow Fannie Mae to more accurately ascertain the true value of a mortgage based on the borrower’s job and location.

Other Recommendations and Insights

Interviewing over 30 different business owners, government officials, and data analysts has immersed us in the tasks and journeys they take every day. The U.S. Department of Treasury should consider the following insights as they continue to improve their data:

1. Businesses want actionable, forward-looking data that can help them plan the procurement process;

2. Businesses and data firms want insights and second-order takeaways beyond the raw data; and

3. Data/analytics firms need open source, standardized entity identifiers to enhance interoperability across data and to show business categorizations.

Thank You

Our team has had an amazing time working together with the U.S. Department of Treasury. We’ve learned so much about small business and data firms and the opportunities and challenges they face. We are excited to be able to hand Treasury the result of our work and to see how they use it to continue making government spending data open and accessible!

Will Long, Maya Perl, Anna Ponting, Cindy Yang, Ni Xu